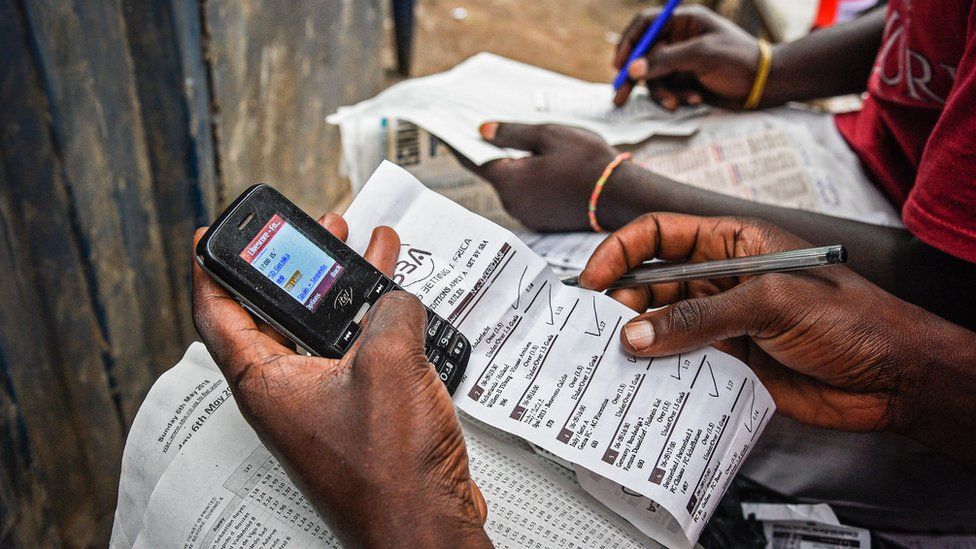

In a surprising turn of events, more than 30 gambling operators were banned from conducting business. The public was cautioned against engaging with these brands as they were declared illegal by the Constitution of the Federal Republic of Nigeria 1999 and were found to contravene the provisions of the Lagos State Lotteries and Gaming Authority Law 2021 in its amended form.

The ban affected various sectors and forms of gambling in Nigeria, where strict regulations apply to both online betting sites in Nigeria and land-based gambling. The Lagos State Lotteries and Gaming Authority (LSLGA) accused these brands of failing to obtain the necessary licenses from LSLGA. As a result, that has put them in violation of Section 33(3) of the law.

This section explicitly states that “a person without a subsisting license or authorization from the Authority shall not conduct or operate any gaming activity in the State.”

List of banned Operators.

The list included the following; Zebet, Betika, Gobet, MSport, 22Bet, Afribet, Bestbet360, Bangbet, Betwazobia, Netbet, Nairamillion, Western Lotto, Elliest Lotto, Riderlotto, Peelslotto, Setlotto, Hamabet, Koretbet, Paripesa, Megabet, Livescorebet, Blackbet/Bettybingo, Cloudbet, Sportbet.IO, Hallabet, Oddspedia, N1bet, Ngawin, Millionairepowerplay, Lottomania, Firstbet, Betxperience, Giveraffle, Konfambet, Wakabet, Betfarm, Scrath2win, Chopbarh, Naijabet, Plentymillions, Nairapowerbet, Gamespay and Xtragoalsfantasy.

Controversy that sparked after the Ban

The ban on over 30 gambling operators in Nigeria sent shockwaves through the industry, leaving both the public and operators puzzled and demanding answers. One of the major sources of confusion stemmed from the fact that several of the banned operators held licenses issued by the National Lottery Regulatory Commission (NLRC). This federal body oversees gambling activities in Nigeria.

Zebet, a prominent betting operator on the banned list, was quick to respond, emphasizing their federal license granted by the NLRC. They invited the public to review their official federal license on the NLRC website, further confirming that their authorization covers the entirety of Nigeria, not just Lagos.

This revelation ignited a crucial debate about the regulatory framework in Nigeria. Some users have raised valid questions regarding whether these operators, despite having federal licenses, need additional licenses at the state level to operate within Lagos. The ambiguity lies in whether these companies require physical offices within Lagos to necessitate a state license.

For example, 22Bet, one of the banned operators, does not maintain physical offices in Lagos. This led to speculation that they might not need a Lagos State Lotteries and Gaming Authority (LSLGA) license. Such complexities in licensing procedures highlighted the need for greater clarity and transparency within the regulatory landscape of Nigeria.

The ban didn’t only create confusion but also brought to the forefront the importance of streamlining licensing procedures and ensuring that operators fully understand their compliance requirements at both federal and state levels. As the industry navigates these challenges, it is clear that regulatory authorities and operators must work together to establish more precise guidelines and promote a more cohesive and transparent regulatory environment for Nigeria’s gambling sector.

Following the witnessed frenzy by the Nigeria betting industry following the ban that was imposed by The Lagos State Lotteries and Gaming Authority (LSLGA) on more than 30 betting operators. The public was warned against engaging with these brands, declared illegal under the Federal Republic of Nigeria 1999 Constitution, allegedly contravening provisions in the Lagos State Lotteries and Gaming Authority Law 2021.

The ban left operators and the public perplexed, as many of the banned operators held licenses issued by the National Lottery Regulatory Commission (NLRC). This confusion led several operators to provide evidence of their licenses obtained through the NLRC to operate nationwide in Nigeria, not just within Lagos.

In response to the controversy, the NLRC has issued a statement aimed at providing clarity on the situation. The NLRC expressed regret for any misunderstanding caused by the ban announcement, stating, “NLRC deeply regrets any misconceptions the unfortunate publication may have caused national gaming licensees operating within the ambit of the law in Nigeria.”

According to the NLRC statement, the following gaming operators, previously listed as “unlicensed and illegal” by the Lagos State Lotteries and Gaming Authority (LSLGA), are indeed licensed to conduct lottery and sports betting business throughout Nigeria: ZEBET, BETIKA, GOBET, MSPORT, AFRIBET, BANGBET, BETWAZOBIA, KORETBET, 22BET, PARIPESA, LIVESCOREBET, BLAVKBET/BETTY BINGO, CLOUDBET, HALLABET, N1BET, KONFAMBET, SCRATCH2WIN, NAIJABET, LOTTOMANIA, AND MILLIONAIRE POWERPLAY.

Source: Betting Companies Africa