Bid Process for South Africa’s 2025 Lotto Licence Begins

South Africa’s National Lotteries Commission held a briefing session in September for prospective bidders for the National Lottery in anticipation of the license renewal in May 2025. The NLC issued a clarification in relation to the briefing session for the fourth national lottery and sports pools licence on 30 and 31 August 2023: “ Prospective applicants and interested parties who wish to attend the briefing session in relation to the Request for Proposal for the Fourth National Lottery and Sports Pools Licence (“RFP”)on 30 and 31 August 2023 are herewith advised that attendance of the briefing session is not compulsory for prospective applicants who intend to submit an application for the Licence. The briefing session is primarily an information session for prospective applicants and interested parties to obtain critical information relating to the RFP document and the application process. Prospective applicants may therefore be represented by one or more persons who may collectively or individually attend the briefing session on behalf of an entity to be formed in due course.

The NLC will record attendance at the briefing session and issue attendees with certificates of attendance which are to be submitted together with an applicant’s application. Failure to attend the Briefing Session or submit a certificate of attendance will, however, not result in the disqualification of a bid. Prospective applicants and interested parties are advised that after the conclusion of the briefing session, prospective applicants may only communicate with the NLC through the medium of a virtual data room or VDR to which access will only be provided upon the purchase of an RFP document and payment of the required fee. All enquiries and requests for additional information regarding the RFP, technical interpretation of the RFP or other matters requiring clarification by interested parties or applicants registered in terms of the RFP, must be made and submitted online via the VDR after the briefing session. The NLC will only respond via the VDR and no other form of communication will be accepted by the NLC. Engagement with the NLC regarding any matters concerning the RFP or application process after the conclusion of the briefing session will therefore require the purchase of an RFP document from the NLC. Prospective applicants are therefore encouraged to attend the briefing session for the full allocated time on both days.”

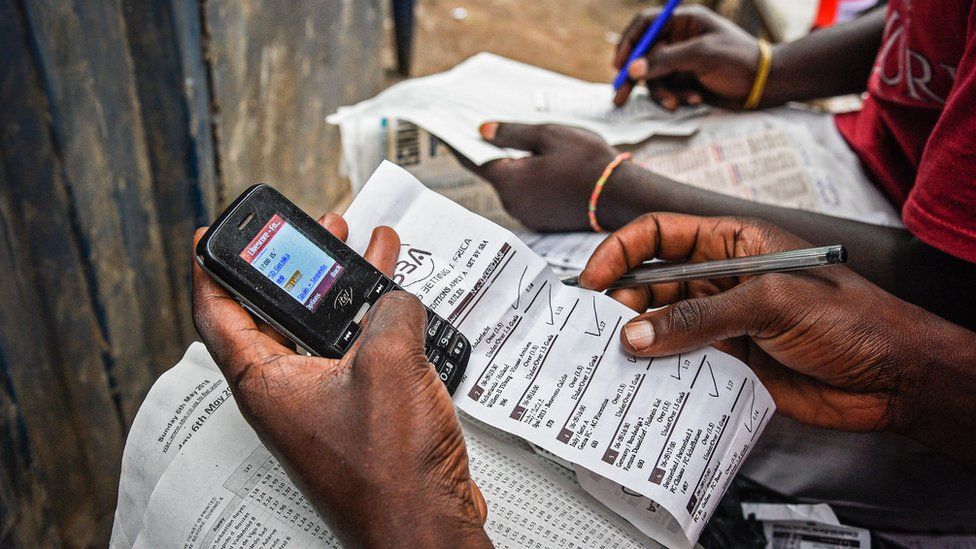

While the lucrative, and often controversial, licence renewal is only set for May 2025 the process has already kicked off and bidders can expect to pay R55 000 for access to documents and data around the lottery and access to a set of documents and a “virtual data room” that will tell them, in considerable detail, how money flows through the lottery system, from independent ticket vendors right through to payouts. Prospective bidders will then have five months to turn that information into proposals on how, given the chance, they would run the lottery when current operator Ithuba’s licence expires in May 2025.

In theory, those proposals must be submitted in early February in order for them to be properly evaluated and a winner announced in plenty of time for a smooth transition. But the odds of things going to schedule seem slim.

Ithuba won its licence in 2014 but was still fighting off a challenge from its predecessor Gidani into 2016. In 2007, the lottery was paused for half a year while Gidani’s predecessor and SA’s first operator, Uthingo, challenged being replaced. With every change of operator, the way the lottery runs and the secondary games around it have changed. Ithuba has indicated it hopes to be the first-ever operator to get a second term running the lottery, but Hosken Consolidated Investments (HCI) told shareholders it has already put together “an exciting bid”.

The scale of the opportunity the lottery represents has traditionally attracted a large number of interested parties, at least in the early stages of bidding, before significant investment is required. And that investment is significant. One insider has estimated that putting together a full bid can easily cost at least R15 million, and during the previous adjudication process bidders were required to put up a performance bond of R125 million.

The groups putting up that kind of money reconcile themselves with the possibility of further delays. Ithuba’s licence had been due to run only until May 2023 but was extended because, said the Department of Trade, industry and Competition (dtic), of the exceptional circumstances Covid-19 represented. As of last week, the dtic is committed to a timeline that includes the end-August briefings, a deadline of 31 October to pay for access to the data around the lottery, and the early-February deadline to submit bids. However, all those dates are subject to representations and legal challenges and, having extended the current licence once already, it could be hard to argue against further extensions.

Source: Gaming for Africa