Uganda’s Gambling Laws and Their Role in Responsible Play

The laws in Uganda help promote responsible gambling, which helps ensure that players enjoy gambling and never get addicted. This is done by making sure that every operator working in Uganda adheres to ethical standards. It is also critical that every player who gambles on a platform in the country understands the risks of gambling addiction.

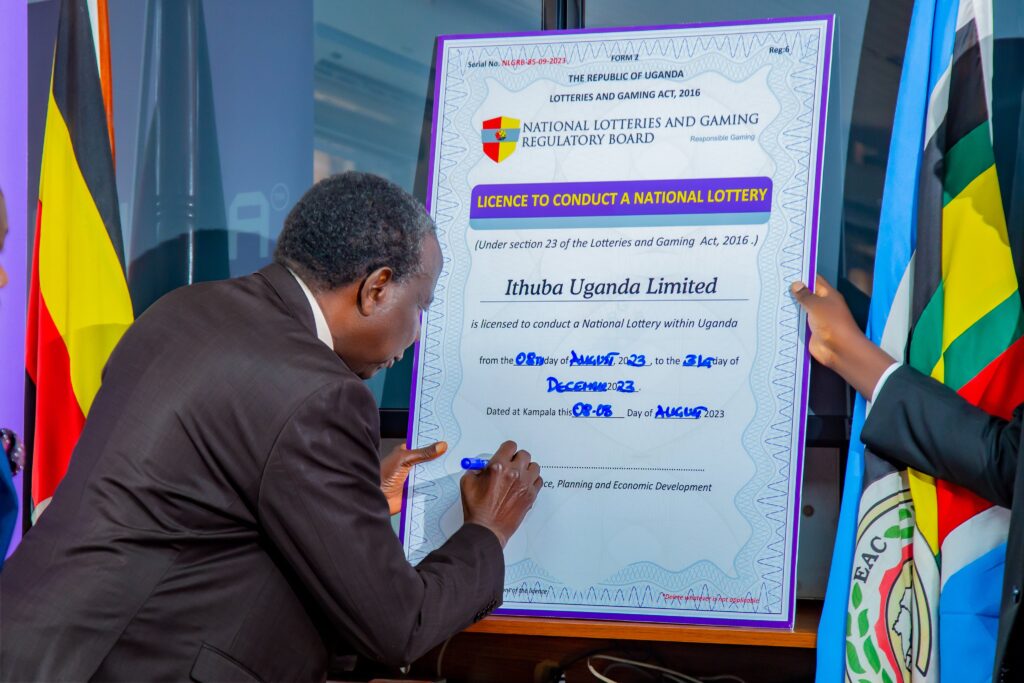

Uganda’s gambling regulations have changed drastically over the last decade as the country tries to promote responsible gambling. It is the Lotteries and Gaming Act 2016 that regulates how local gambling establishments operate. Through this article, we are dedicated to exploring what safety practices the country uses to protect its players and contribute to responsible gambling.

Key points of Uganda’s gambling laws

When it comes to regulation and licensing in Uganda, the Lotteries and Gaming Act 2016 helped establish the National Lotteries and Gaming Regulatory Board. This board is responsible for all types of gambling within Uganda. This includes lotteries, online casinos, and sports betting. While NonGamStopCasinos.org.uk is popular among UK gamblers, players in Uganda should be more careful about choosing a casino platform since in their country the support system for vulnerable players isn’t as strong in the UK.

Responsible gambling is important in the country, and operators must promote responsible gambling practices. Casino providers must display details about the risks of gambling and include gambling tools such as self-exclusion programs, deposit limits, and time-out features.

Uganda gambling law seems to take players’ age seriously since here, individuals must turn 25 to be able to access online casino platforms. This is significantly different from the gambling age rule in the UK, US, NZ, AU, and Europe.

Money laundering compliance is a commitment from Uganda to stop any form of illegal money laundering. Uganda gambling law requires establishments to follow strict with anti-money laundering regulations, which help to ensure that the industry does not facilitate illegal activity.

Taxation collection plays an important role in the gambling framework in Uganda. All operators must pay taxes on their revenues, and all casino winnings are also taxed. The tax from gambling helps the country with public welfare programs that focus on education.

Monitoring and enforcement is a job that is completed by the National Lotteries and Gaming Regulatory Board. They must make sure that every operator complies with regulations at all times. If any operator is in breach and does not comply with the regulations, fines and suspensions can be given. In some circumstances, operators may have their licenses removed.

Gambling laws in promoting responsible play in Uganda

The laws in Uganda help promote responsible gambling, which helps ensure that players enjoy gambling and never get addicted. This is done by making sure that every operator working in Uganda adheres to ethical standards. It is also critical that every player who gambles on a platform in the country understands the risks of gambling addiction.

Each operator in Uganda must assist those players who are vulnerable and protect them from exploitation. Having age verification in place to prevent underage gamblers from getting involved in forms of gambling is essential. When there is a combination of robust licensing requirements, as well as responsible gambling practices, players can benefit.

The National Lotteries and Gaming Regulatory Board works efficiently to create a secure gaming industry that contributes positively to the country’s economy and protects young individuals from financial loss and mental issues. All of this is in conjunction with safeguarding every gambler who plays at a site in Uganda from the potential harm of addiction.

Similarities with the UK gambling provisions

All of these measures in place protect players and ensure the gaming environment is fair and transparent. If we compare this to how the UK Gambling Commission operates, it is fairly similar. Except in the UK, there are lots of non-GamStop casinos which are extremely popular with gamblers. The issue with the non-GamStop gambling platforms is they lack responsible gambling tools. However, Uganda’s gambling sector can learn from the UK by implementing stricter regulations and promoting responsible gambling tools to ensure a safer and more accountable gaming environment.

These types of tools help prevent gambling addiction and promote safe gambling habits. Gambling must be enjoyed and used as a form of entertainment rather than a way of making money. Once gambling stops being fun, it may be time to reevaluate and consider what you are doing. With the UK and non-GamStop gambling sites, players have more freedom but less responsibility.

GamStop protects gamblers from harmful addictions that can take over their lives. Having the opportunity to use tools like deposit limits and time-outs makes it easier for players to watch their habits. Through non-GamStop sites, players get all the same casino games, but they must take responsibility for themselves.

Sumary

As Uganda takes gambling seriously, it can be a choice for many gamblers from other countries. Playing on Uganda gambling platforms offers a unique experience for players. These sites will not be part of the GamStop casinos, but they still offer safety and security. Gambling online is all about common sense and being self-aware. Always gamble with money you can afford to lose, and make sure you enjoy the experience.

Source: nilepost.co.ug